In our first edition of CIO Monthly for 2023, we take a look at how the outlook has evolved over the recent festive months. While we’ve made no changes to the cautious but constructive recommended tactical asset allocation adopted in December, we highlight a number of positive developments. Early 2023 has revealed clearer signs we are passing the peak in inflation and central bank hawkishness, while China’s accelerated re-opening and Europe’s warmer-than-expected winter have both improved the macro outlook. For equities, we remain neutral, highlighting the risk of near-term weakness, while encouraging portfolio rebalancing where equity allocations have drifted above their tactical targets.

“December’s US inflation data was another example ... that is, another demonstration that we have had peak inflation and, with that, peak Fed hawkishness.”

This time last year, virtually all 2022 outlook documents were struggling for relevance, damaged by unanticipated January events. The US Federal reserve (Fed), in its 5 January minutes, had signalled imminent near-term rate hikes, previously slated for much later in the year. And by late January, Russian troops were amassing on Ukraine’s border (albeit most geo-political strategists at the time viewed an actual incursion as unlikely).

As the end of the first quarter approached, hopes of a ‘soft landing’ for growth as post-pandemic inflation peaked were already giving way to the reality that sharply higher energy prices and more rapidly rising rates were on course to deliver a stagflation-like shock for 2022, with inflation and rates sharply higher and growth (potentially) sharply lower.

The unfolding global spike in energy costs would, together with the now increasingly obvious over-stimulatory monetary and fiscal policy through 2021, render the task of slowing growth (to ease inflation risks) a challenge. This is despite the seemingly unending and larger-than-expected monthly rate hikes across most economies.

“Participants concurred that the Committee had made significant progress over the past year in moving toward a sufficiently restrictive stance of monetary policy."

As 2023 gets under way and the end of January approaches, the broad gambit of most macro outlooks appears intact, at least as much as it ever does. Indeed, our own macro views, largely unchanged since mid-last year, have also weathered the festive season relatively well. Inflation appears to be passing its peak, central banks appear on the cusp of a pause from raising rates in Q1, and geo-politics have a touch of calm, with China taking a more inclusive tone at January’s World Economic Forum in Davos.

Indeed, this year’s January Fed minutes—while still noting inflation remains too high and rates have further to rise—recognised risks in both directions. While there is a risk that policy may end up being insufficiently tight, the Fed is now also balancing this against the risk, for the first time, that “the lagged cumulative effect of policy tightening could end up being more restrictive than necessary”. Other central banks are raising similar concerns.

Inflation has also started to come down in the UK and Europe, several months behind the pace of improvement in the US.

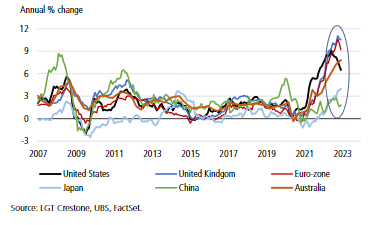

Inflation has also started to fall in the UK and Europe, several months behind the pace of improvement in the US. As the chart above shows, US (headline) inflation has eased from 9.1% in June to 6.5% in December. European inflation has eased from 10.6% to 9.2%, while in the UK, it has fallen more modestly from 11.1% to 10.5%.

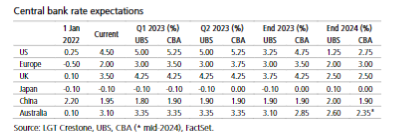

While Europe and UK central banks retain a hawkish tone, the likely ongoing downward trend in inflation still argues for a pause in policy tightening soon. Even Australia’s Federal Treasurer Chalmers is hoping that this month’s higher-than-expected rise in Australia’s Q4 inflation to 7.8% (its highest since early 1990) will be the peak, allowing the Reserve Bank of Australia (RBA) to pause its rate rising cycle at 3.35% after a likely February hike. The table below shows that central bank rate expectations (from UBS and CBA) are nearing their peak, likely to pause around Q1, before only tentatively beginning an easing cycle late this year. This follows the sharp rate hikes through 2022 (also shown in the table).

Europe has been very successful in filling its gas storages in recent months to well above five-year averages. According to UBS, current levels of 83% are almost 15 percentage points above the 70% five-year average.

Early 2023 has also delivered two further positive developments that strengthen the case for a ‘soft-ish’ landing for the global economy over the coming year, rather than a deep global recession, that had has had favour at times through 2022.

If ongoing falls in inflation encourage a pause in hikes before growth momentum is dashed, then the risk of a softer landing for markets and economies is probably higher than it was when we exited 2022 ... Yet, history still lands firmly on the side of a worsening economic backdrop during 2023.

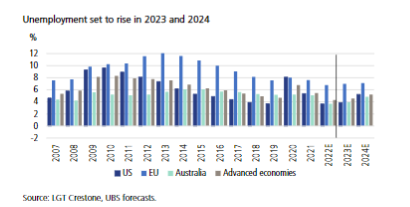

In the 1980s and 1990s, getting inflation under control proved difficult for central banks. It required a huge increase in the so-called ‘sacrifice ratio’—an economic metric of how much unemployment needs to rise (or how much output needs to be lost) to get inflation down. Unemployment rose from 6% to 11% in the US in the 1980s and did broadly the same in Australia in the 1990s, as both countries sought target inflation closer to 2%.

Relative to a few months ago, it appears that the extent of ‘sacrifice’ needed in 2023 could be lower than previously feared. If ongoing falls in inflation can encourage a pause in hikes beforestillresilienteconomicgrowthmomentum is dashed, then the risk of a softer landing for both economies and markets is probably higher than it was when we exited 2022.

Yet, history lands firmly on the side of a worsening economic backdrop during 2023. The full weight of rapidly rising interest costs is yet to be felt by households and businesses (albeit housing markets have been showing clear weakness). It is likely that a level of sacrifice (i.e. some rise in unemployment both here and offshore) will be needed, if only to give central banks confidence that inflation is on a sustained path back to normal.

Still, recent positive developments have led to some modest upgrades to the global economic outlook. Late last year, the Organization for Economic Cooperation and Development (OECD) cut its 2023 forecast from 2.8% to 2.2%—a near-recessionary outlook after a likely 3.0% rise in 2022. This year, CBA has lifted its outlook from 1.8% to 2.0% on a stronger China and Europe outlook, rising to 2.6% in 2024.UBS sees a similar pace of 2.2% (was 2.1%) for 2023, rising to 2.7% in 2024. UBS has also raised its China forecast from 4.5% to 4.9% and flagged upside risks to its European outlook.

If ongoing falls in inflation encourage a pause in hikes before growth momentum is dashed, then the risk of a softer landing for markets and economies is probably higher than it was when we exited 2022 ... Yet, history still lands firmly on the side of a worsening economic backdrop during 2023.

While far from certain, developments as we enter 2023 suggest a softer landing is now more plausible. And while markets are unlikely to be great, there’s now some chance they may be better as we move through 2023.

For markets, despite a likely poor macro backdrop, there’s every chance that a steadier rate environment proves somewhat of a panacea. Yes, current earnings expectations remain too high and a headwind to returns (as discussed below). And the downside of a softer economic landing is that central banks may pause their hikes but are less likely to pivot to cuts (reflected in the only modest rate cuts at the end of this year in the table above).

Still, while far from certain, developments as we enter 2023 suggest a softer landing is now more plausible. And while markets are unlikely to be great, there’s now at least some chance they may be better as we move through 2023.

So, as we enter 2023, we maintain our relatively defensive (but not bearish) portfolio positioning that we’ve maintained for much of H2 2022. This involved resisting the temptation to move underweight equities from mid-year as the market bottomed, while moving progressively more in favour of fixed income through the year as central banks lifted interest rates. In our 2023 outlook, we tilted our view somewhat more constructively, and most of those decisions have added value.

The downside of a softer economic landing is that central banks may pause their hikes, but they are less likely to pivot to cuts.

For equities, the extent of the market weakness that will force a central bank pivot (or pause), the magnitude of that pivot and subsequent macro and market recovery remain key uncertainties in early 2023.

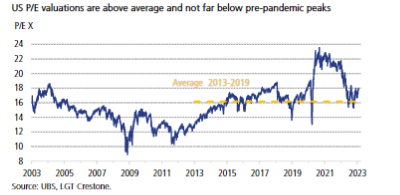

If history is any guide, a likely material slowing in economic growth, with still elevated inflation and interest rates, is yet to be adequately reflected in equity market earnings. And the US market remains one of the most stretched on these metrics. As shown in our signals table above, we are yet to fully achieve the four signals required to take an overweight equity view. The final earnings signpost is likely to be clearer by end-February, as US, European and domestic equity reporting seasons wrap up.

For now, we continue to see 2023 as a game of two halves. Firstly, a period of market turbulence amid rate-induced macro weakness that leads to cuts to the earnings outlook. An ongoing re-allocation by market participants from equities to bonds (given bonds are now an attractive asset class) is likely to add to this volatility. The ‘other half’ should be a period of stabilisation as the earnings backdrop steadies and moderately improves.

We expect this initial market weakness will eventually force central banks to pause hiking rates around the end of Q1, and for the most advanced (and aggressive) central bank, the Fed, we expect a so-called ‘pivot’. However, the extent of the market weakness that will force such a central bank pivot, the magnitude of that pivot, and subsequent macro and market recovery remain key uncertainties. It is hard to give a precise answer, but we believe that:

Given the recent rally in equity markets, it is possible that portfolio equity allocations have drifted above their tactical and strategic targets ... where this is meaningful, the opportunity to rebalance portfolios via trimming equity positions near term should be considered.

As we enter 2023, developments suggest a softer landing is now more plausible—but it’s certainly far from certain. And while markets are unlikely to be great, there’s now at least some likelihood they may be better than in 2022—and less bad than first feared.

We continue to favour fixed income and alternative investments, given immediate inflation protection, competitive expected returns, and the likelihood that only a steady decline in inflation (rather than collapse) will underpin only modest reductions in rates over the coming year. For equities, we remain constructive (neutral), with a preference for some non-US markets (such as Australia and emerging markets). Upside risks to this view include continued consumer and corporate resilience, or a sharp near-term decline in inflation that could prompt a Fed pivot without significant economic damage (a true soft landing).

Given the recent rally in equity markets, it is possible that portfolio equity allocations have drifted above their tactical and strategic targets. Where this is meaningful, the opportunity to rebalance portfolios via trimming equity positions near term should be considered. This could also be an opportunity to further rebalance within asset classes. For example, within equities, investors can reduce prior high exposures to growth (particularly given the strength in the NASDAQ market) and reduce tracking error through benchmark-aware managers, while ensuring a sufficient exposure to value managers through the cycle.

This document has been prepared by LGT Crestone Wealth Management Limited (ABN 50 005 311 937, AFS Licence No. 231127) (LGT Crestone Wealth Management). The information contained in this document is of a general nature and is provided for information purposes only. It is not intended to constitute advice, nor to influence a person in making a decision in relation to any financial product. To the extent that advice is provided in this document, it is general advice only and has been prepared without taking into account your objectives, financial situation or needs (your Personal Circumstances). Before acting on any such general advice, we recommend that you obtain professional advice and consider the appropriateness of the advice having regard to your Personal Circumstances. If the advice relates to the acquisition, or possible acquisition of a financial product, you should obtain and consider a Product Disclosure Statement (PDS) or other disclosure document relating to the financial product before making any decision about whether to acquire it.

Although the information and opinions contained in this document are based on sources we believe to be reliable, to the extent permitted by law, LGT Crestone Wealth Management and its associated entities do not warrant, represent or guarantee, expressly or impliedly, that the information contained in this document is accurate, complete, reliable or current. The information is subject to change without notice and we are under no obligation to update it. Past performance is not a reliable indicator of future performance. If you intend to rely on the information, you should independently verify and assess the accuracy and completeness and obtain professional advice regarding its suitability for your Personal Circumstances.

LGT Crestone Wealth Management, its associated entities, and any of its or their officers, employees and agents (LGT Crestone Group) may receive commissions and distribution fees relating to any financial products referred to in this document. The LGT Crestone Group may also hold, or have held, interests in any such financial products and may at any time make purchases or sales in them as principal or agent. The LGT Crestone Group may have, or may have had in the past, a relationship with the issuers of financial products referred to in this document. To the extent possible, the LGT Crestone Group accepts no liability for any loss or damage relating to any use or reliance on the information in this document.

This document has been authorised for distribution in Australia only. It is intended for the use of LGT Crestone Wealth Management clients and may not be distributed or reproduced without consent. © LGT Crestone Wealth Management Limited 2023.